Table of Contents

The covid-19 pandemic caused robust financial markets across the globe to topple, but through the quite tumultuous past year, the crypto market managed to hold its own and even performed better than ever. The DeFi space spawned an astounding number of new, innovative projects, and 2020 came to be known as the year of the DeFi. Bitcoin emerged as the ruling alternative investment asset class of 2020, dethroning gold.

Now, all the achievements of the crypto space in 2020 led crypto enthusiasts to believe this winning streak will continue in 2021. However, as we stand in the middle of 2021, the crypto markets seem to be going through pretty turbulent times. Leading crypto assets like Bitcoin, Ethereum, and more have been crashing hard; at the end of June 2021, the price of Bitcoin had been down by nearly 50% since April, Ethereum had decreased by about 53% since May. Memecoins fell as well – Dogecoin had dropped by around 60% since the beginning of May.

Even as many crypto users have been panicking, fearing the arrival of a bear market, what not many realize is that crypto itself is not any weaker despite this major crash in crypto prices. In fact, just like it held its own through the initial shock of the pandemic, crypto is still going strong, and at the moment is perhaps more powerful than ever.

In this post, we take a look at the reasons for the crypto market crash, and how, despite everything, crypto wasn’t affected.

So, What Caused the Crypto Market Crash?

A number of factors can be cited as the reason for the recent crypto price slump. Firstly, there’s China’s crackdown on crypto mining; the country forbade Bitcoin mining in the Sichuan province due to environmental concerns and further, restricted Chinese banks from facilitating transactions that have anything to do with crypto.

With China’s recent attack on crypto comes Elon Musk’s recent move against Bitcoin. Just in February 2021, Musks announced his company Tesla would start accepting Bitcoin as payment, which sent the prices of Bitcoin touching new highs in March and April. However, soon Musk took a sharp u-turn when he said that Tesla wouldn’t be accepting Bitcoin anymore and again stated environmental concerns as his reason. Musk said, “We are concerned about rapidly increasing use of fossil fuel for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel.”

Musk is regarded as one of the most influential celebrities within the crypto space, so of course, his renouncement of Bitcoin had an instant impact on the crypto market, and along with Bitcoin, many other digital tokens also witnessed a sharp decline in prices. On the other hand, meme coins like Dogecoin dived primary because of Musk’s influence with significant drops in price.

While the aforementioned two were the biggest reasons to trigger the crypto market crash, there’s also Warren Buffett, Bill Gates, and the U.S. Treasury Secretary Janet Yellen’s negative comments regarding Bitcoin.

The Aftermath of the Crash: Bitcoin Fundamentals Still Rock Solid

Sure, Bitcoin erased its 2021 gains. But even as it hit a record low of below $30,000 in June 2021 and the others among the top 10 cryptocurrencies also witnessed a significant decline in prices, practically nothing in the cryptocurrencies has fundamentally changed. Therefore, even though the recent crypto market crash can seem intimidating, crypto is still as strong as it has always been.

As cryptocurrencies have proven, again and again, their inherent systems are capable of powering through times of stress, and they always emerge stronger on the other side of volatile market conditions. For instance, historically speaking, this is not the first time China has put a ban on crypto. Back in 2013, China banned Bitcoin as a transaction medium, in 2017 the government shut down all local crypto exchanges, and even in 2019 something similar was going on. And yet, none of that affected crypto in the long run. Plus, on multiple previous occasions, Bitcoin lost more than 80% of its value, and it’s always bounced back. Even Ethereum lost about 95% of its value in 2018 and recovered shortly. It’s true that history doesn’t ensure a solid future, but it does prove that cryptocurrencies have seen worse than the recent price slump and yet survived.

This time, as many newcomers within the crypto space are hurrying to sell their holdings, long-term investors are being seen accumulating. For instance, the balance in addresses that are holding Bitcoin is only going up as the crypto’s price further fluctuates. It’s safe to assume these people are all confident about future profits.

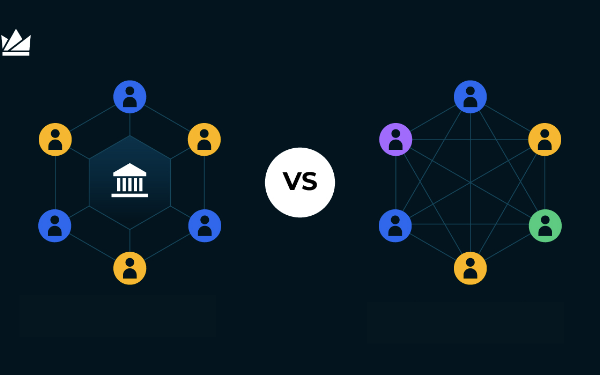

Further, as Raoul Pal, the founder of Real Vision, notes in one of his Twitter threads, even amidst the market crash, there was no string of collateral losses, nor was there any collateral pressure. Stablecoins carried on as always, and no crypto exchanges bore big losses or had a need to mutualize losses. No user suffered open-ended losses, and the DeFi space went on as normal. In fact, in 2021, the decentralized finance sector is the most powerful it’s ever been. As per DeFi Pulse, the total value locked in DeFi is now over $55B. Unlike traditional finance markets where failing banks are bailed out as it happened in 2008.

In conclusion, crypto has so far proven itself strong enough to withstand the current market condition. Crypto will very likely see many more crashes in the years to come, just like any other financial market. As long as you’re truly invested in the potential of cryptocurrency and have long-term goals and objectives, it doesn’t really matter what the current market conditions are.

If you’re interested in investing in cryptocurrency in India, do give our website a visit!